If you’re having trouble making your monthly mortgage payment to Rushmore, we’re here to help. To start the process, it is important that we receive an accurate and complete Borrower Assistance Application. Please read the following instructions carefully to minimize processing delays.

Downloading the Borrower Assistance Package

Download the Borrower Assistance Application. This package contains a complete set of instructions and forms you need to complete and mail or fax to Rushmore Loan Management Services. We will use the information in this package to evaluate your borrower assistance options.

Important Things to Know

All Forms (Even Non-Applicable Ones) Must Be Filled Out and Returned

It is important that you fill out the entire packet. Please write “not applicable” on any forms that you feel don’t apply to you. All forms, even those you’ve written “not applicable” on, must be returned in order for your application to be complete. Failure to fill out all forms will cause delays in processing your assistance application.

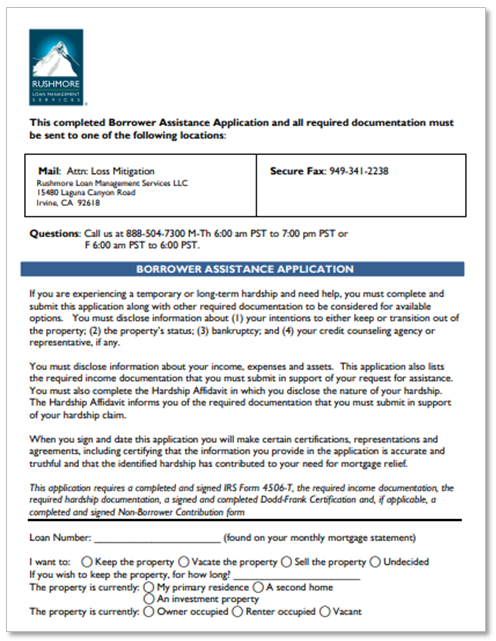

Return Your Completed Application in One of the Following Ways*

*Please do not submit your application in more than one way unless directed to do so by a Rushmore employee. Doing so may cause processing delays.

| Email: | LossMitigation@RushmoreLM.Com |

| Fax: | 949-341-2238 |

| Mail: |

Attn: Loss Mitigation Rushmore Loan Management Services, LLC 15480 Laguna Canyon road Irvine, CA 92618 |

Providing Letters of Explanation

If we request a letter of explanation concerning your situation:

- Use a separate letter of explanation for each topic (such as a letter of explanation giving reasons you can’t supply a required document).

- Include your name and loan number on each letter.

- Sign each letter.

Documenting Expenses

You must provide supporting documents for any expenses you disclose. Common expenses include alimony, child support, liens, and judgments.

Forms All Borrowers Must Provide

All Borrowers must complete the forms below: To process your Borrower Assistance Application, we need a letter describing your intentions. This letter of intent should include: If you are self-employed, please provide: If a non-borrower, such as a child, spouse or non-relative, contributes money towards the mortgage payment and/or household expenses, you need to send us: If your loan is approved for a loan modification, we will create an escrow account for taxes and insurance. As part of your Borrower Assistance Application, we will need a copy of your property hazard insurance declaration page. You can contact your insurance agency to obtain this. If you don’t have or do not wish to get property hazard insurance, we will put insurance on your property. If this is the case, please send us a letter saying you want us to provide “forced place insurance” for your property. If you own rental properties, we will need: Have questions or need help filling out the forms? Give us a call us at 888-504-7300.Letter of Intent

Financial Statements

Paystubs and Bank Statements

Other Proof of Funds

Federal Tax Return

Homeowners’ Association Dues

Fixed Income

If You Are Self-Employed

Non-Borrowers

Properties without Escrowed Taxes and/or Insurance

Rental Properties

Getting Help